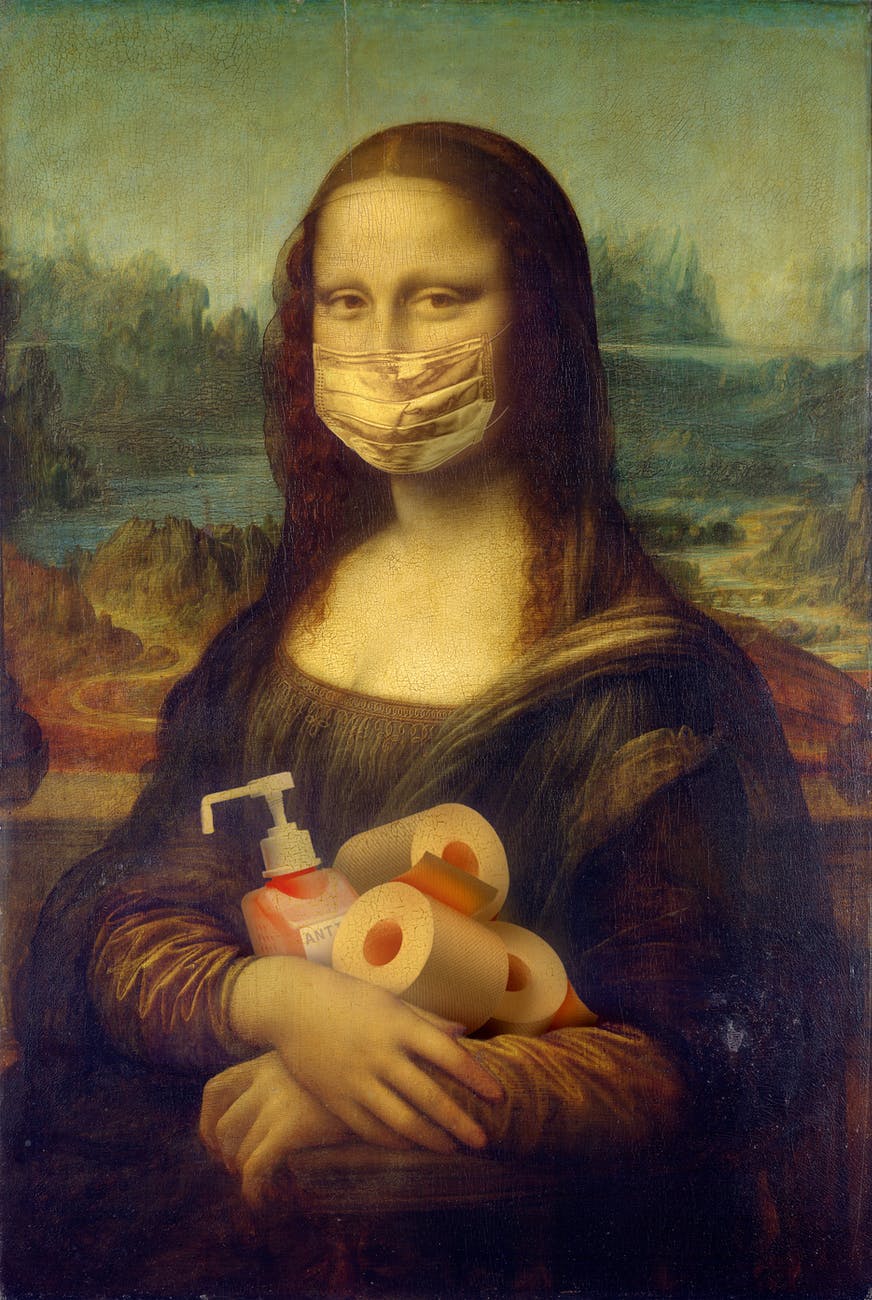

Not the Covid-19 Omnibus (Emergency Measures) Act 2020

Victoria’s Covid-19 emergency measures to assist commercial tenants now have formal legal force with the proclamation of the Covid-19 Omnibus (Emergency Measures) (Commercial Leases and Licences) Regulations 2020.

Some of the new temporary reforms are drastic. For example, paying rent will effectively become optional in the short term for many commercial tenants. And landlords who even attempt to evict such tenants for non-payment will be guilty of an offence.

The new pro-tenant measures will apply to a vast range of retail and non-retail commercial leases for the six months between 29 March 2020 and 29 September 2020.

The changes are effected mainly by the deeming of new terms into commercial leases and licences, but a crucial detail easily overlooked is that the entire scheme is underpinned by the Commonwealth’s JobKeeper scheme. A commercial tenant who is not a qualified participant in the JobKeeper scheme will be effectively excluded from the protections offered by the new rules.

The wide focus

First, a quick refresher and backgrounding for recently arrived Martians and/or anyone too overwhelmed by recent events to have maintained focus.

Retail leases (a very broad concept that commonly includes the leases of shops, offices, serviced apartments and the premises of many other small and medium businesses) are governed by Victoria’s Retail Leases Act 2003. (Although note that the “retail” character of any commercial lease is suddenly less important as the new regime temporarily extends parts of the Retail Leases Act to non-retail commercial leases as well.)

Since March 2020, the snowballing Covid-19 crisis has caused Australia’s federal and state governments to order the partial or complete temporary closure of many businesses nationwide. (In Victoria this has been done mainly by orders under the Public Health and Wellbeing Act 2008.)

The Federal Government has sought to mitigate the widespread financial disruption resulting from these closures with measures including the JobKeeper scheme. The JobKeeper scheme is expected to subsidize the earnings of millions of private sector employees (and some small business principals) for at least six months until September 2020. But it is primarily concerned with maintaining employment relationships. It offers no direct help to landlords or tenants suffering financial distress as a consequence of the Covid-19 crisis.

On 3 April 2020 the National Cabinet announced a Mandatory Code of Conduct for Small and Business Enterprises to impose “a good faith set of leasing principles to commercial tenancies” affected by Covid-19 shutdowns and downturns.

As commercial tenancies have never been considered within the Commonwealth’s constitutional powers and the National Cabinet has the same constitutional status as unicorns under the Australian Constitution (namely none), the Code of Conduct’s claim as of early April to be mandatory was very optimistic in the absence of supporting state statutes and regulations.

The states have accordingly in recent weeks been legislating to give the National Cabinet’s various pronouncements practical legal effect in state-governed areas such as leasing (and much else besides). Victoria’s legislation for this purpose is the evocatively-named Covid-19 Omnibus (Emergency Measures) Act 2020 (“Omnibus Act”) which commenced operation on last Anzac Day , 25 April 2020.

The Omnibus Act is a thumping 299 pages but commercial landlords and tenants need concern themselves with only a slim bite of it. That portion, Part 2.2, sets out parameters for the supporting regulations but, absent those regulations, it has no real practical utility.

However, we now have those regulations. They were promulgated last Friday, 1 May 2020 as the Covid-19 Omnibus (Emergency Measures) (Commercial Leases and Licences) Regulations 2020 (“Omnibus Regs”) but have effect from 29 March 2020 (note the retrospectivity) until 29 September 2020 when they expire (see regs 3 and 25). The regulations aim to give legal force in Victoria to the National Cabinet’s Mandatory Code.

The highlights

The first thing to note about the new regime is that a given tenant’s eligibility for and participation in the JobKeeper scheme is a threshold test.

Only tenants with an “eligible lease” will benefit from the new scheme and the chief criteria for any lease’s eligibility is that that the tenant concerned should be a small or medium enterprise and also a qualified participant in the JobKeeper scheme (see Regs 10(2) of the Omnibus Regs).

Tenants under eligible leases who withhold all or part of their rent will in the short term be deemed not to have breached their leases provided they request rent relief from their landlord in writing, together with prescribed information including showing their eligibility for the JobKeeper scheme (regs 9 and 10).

A landlord receiving such a request from a tenant is then required to offer rent relief to the tenant within 14 days. The Mandatory Code was understood by many to require that landlords give rent relief in direct proportion to their tenants’ drop in revenue but this view must be mistaken as no such requirement appears in the Omnibus Act or the Omnibus Regulations. The Act and the Regulations are the enforceable legal instruments (not the Mandatory Code) and neither of them specify any precise amount or formula for calculating rent relief. Whatever the relief arrived at in a given case, the Mandatory Code, the Omnibus Act or the Omnibus Regulations all require the relief must be in the form of a waiver of rent as to half of that relief and deferral of rent as to the balance of the relief (unless the tenant agrees otherwise).

But back to the obvious key question – what is the amount of the rent relief to be? The answer is that the amount is to be negotiated “in good faith” (per reg 10(5) of the Omnibus Regs) having regard to factors including the reduction in the tenant’s turnover during the six months from 29 March 2020 to 29 September 2020 (which I will call here the “Covid Window”), the amount of time (if any) that the tenant was unable to operate its business at the leased premises, and the landlord’s “financial ability to offer rent relief” (Reg 10). (This “financial ability” concept is intriguing. It might even become the subject of a future blog — after I have dusted off the writings of Mother Theresa, Karl Marx, Robin Hood and Alan Bond.)

Collectively, the changes are overwhelmingly pro-tenant. Tenants can waive some or all their new entitlements, but landlords are hamstrung. A landlord who even attempts to evict a tenant under an eligible lease for non-payment of rent or to call up bank guarantees in response to non-payment of rent will potentially in each instance be guilty of an offence punishable by a fine of 20 penalty units (being $3304.44) (Reg 9)

Tenants, however, don’t get a perpetual free kick. In the absence of a renegotiated lease (which might include rent deferrals and lease extensions on top of the compulsory rent waiver), the parties are to mediate their dispute through the Small Business Commission (reg 20) and, failing success there, litigate it (reg 22). Reg 22 suggests that VCAT will retain its current exclusive jurisdiction for retail lease disputes and will additionally acquire non-exclusive jurisdiction for non-retail commercial lease disputes. VCAT’s “no costs” presumption is likely to apply to both retail and non-retail lease disputes (see s. 92 of the Retail Leases Act 2003 and s. 109(1) of the Victorian Civil and Administrative Tribunal Act.)

None of this is likely to be good news for landlords.

Commercial tenants large and small are struggling. Cash flows across the economy are faltering. Commercial vacancies are climbing. Reliable replacement commercial tenants are likely to become very rare birds. And, to top it all off, the Business and Property List of VCAT (which will hear this type of dispute) is functionally closed for the foreseeable future. When VCAT does eventually reopen, it will inevitably be gummed up by the backlog of cases that have gone unheard during its closure. And that is even before the coming avalanche of Covid-19 rental disputes hits the Tribunal.

This looming traffic jam at VCAT must cast a shadow over rent relief negotiations between tenants and landlords.

The Mandatory Code and the Omnibus Regulations both require landlords and tenants to negotiate their revised arrangements in good faith. As ever in these things, our lawmakers’ attempt to compel good faith seems oxymoronic. Either good faith exists in a given relationship and the formal requirement for it is redundant or bad faith exists and nothing in the Code or the Omnibus Regulations will cure that problem.

A cynical tenant might cut its cloth accordingly. The tenant and landlord who cannot voluntarily agree to a revised rental arrangement will join a long and growing queue to have their squabble determined in VCAT and (assuming the tenant’s compliance with reg 10) the tenant is most unlikely to be evicted at any time before the hearing for its non-payment of Covid Window rent.

Smart (or desperate) landlords caught in this bind might well prefer the short-term certainty of agreeing to a steeply discounted rental income to the uncertainty of waiting a long time to argue their case in VCAT.

Finally, the disclaimer. The Covid-19 commercial rent regime is new and untested. It is likely to be tweaked in the coming months. My thoughts and summaries above are both general and incomplete. If you are a tenant or a landlord you should not rely upon this blog as a substitute for legal advice tailored to your particular circumstances.